CG Insights

Explore the latest trends and insights in technology and culture.

Insurance Quotes: Why They’re Like Your Ex’s Texts

Discover why insurance quotes are just like your ex's texts—full of surprises and worth a second glance! Click to find out more!

The Importance of Comparing Insurance Quotes: Lessons from Past Relationships

When it comes to selecting the right insurance policy, comparing insurance quotes is a crucial step that can save you both time and money. Just like in past relationships where we often weighed the pros and cons of staying with one person versus exploring other options, the same logic applies to insurance shopping. By taking the time to evaluate multiple quotes, you can discover varying coverage levels, premiums, and benefits that may better suit your needs. It's important not to settle for the first offer that comes your way; instead, find the best matches for your unique situation.

Moreover, assessing different insurance quotes teaches us to recognize value beyond mere appearances. In relationships, we often overlook red flags in favor of initial attraction, leading to unfavorable outcomes. Similarly, insurance policies may seem attractive on the surface but could lack critical coverage options. When comparing quotes, look for essential features such as deductibles, coverage limits, and customer reviews. This careful examination helps ensure that you choose a policy that offers comprehensive protection rather than just the cheapest option available. Remember, a wise choice today can prevent expensive regrets down the line.

Why Ignoring Insurance Quotes is Like Ignoring Your Ex's Red Flags

Ignoring insurance quotes can be just as perilous as dismissing the red flags in a past relationship. Just as you learned to recognize the warning signs that indicated your ex might not be the right fit, you should also develop an eye for potential risks in your insurance options. If you neglect to compare quotes, you might end up paying more than necessary for coverage that doesn’t adequately meet your needs. The discomfort of overpaying or being underinsured can haunt you long after the decision is made, similar to the anxiety stemming from unresolved issues in a past relationship.

Furthermore, just as every relationship has its warning signs, each insurance policy has its unique conditions and limitations that warrant careful consideration. By ignoring insurance quotes, you risk falling into a trap, ensnared by misleading promises or offers that seem too good to be true. Address the quotes head-on and scrutinize them with the same intensity you would when reevaluating your past partner’s red flags. Taking the time to analyze and compare your options will lead to a more secure and valuable policy, ensuring you don’t find yourself regretting your choice down the line.

Navigating Insurance Quotes: What to Look For and What to Avoid

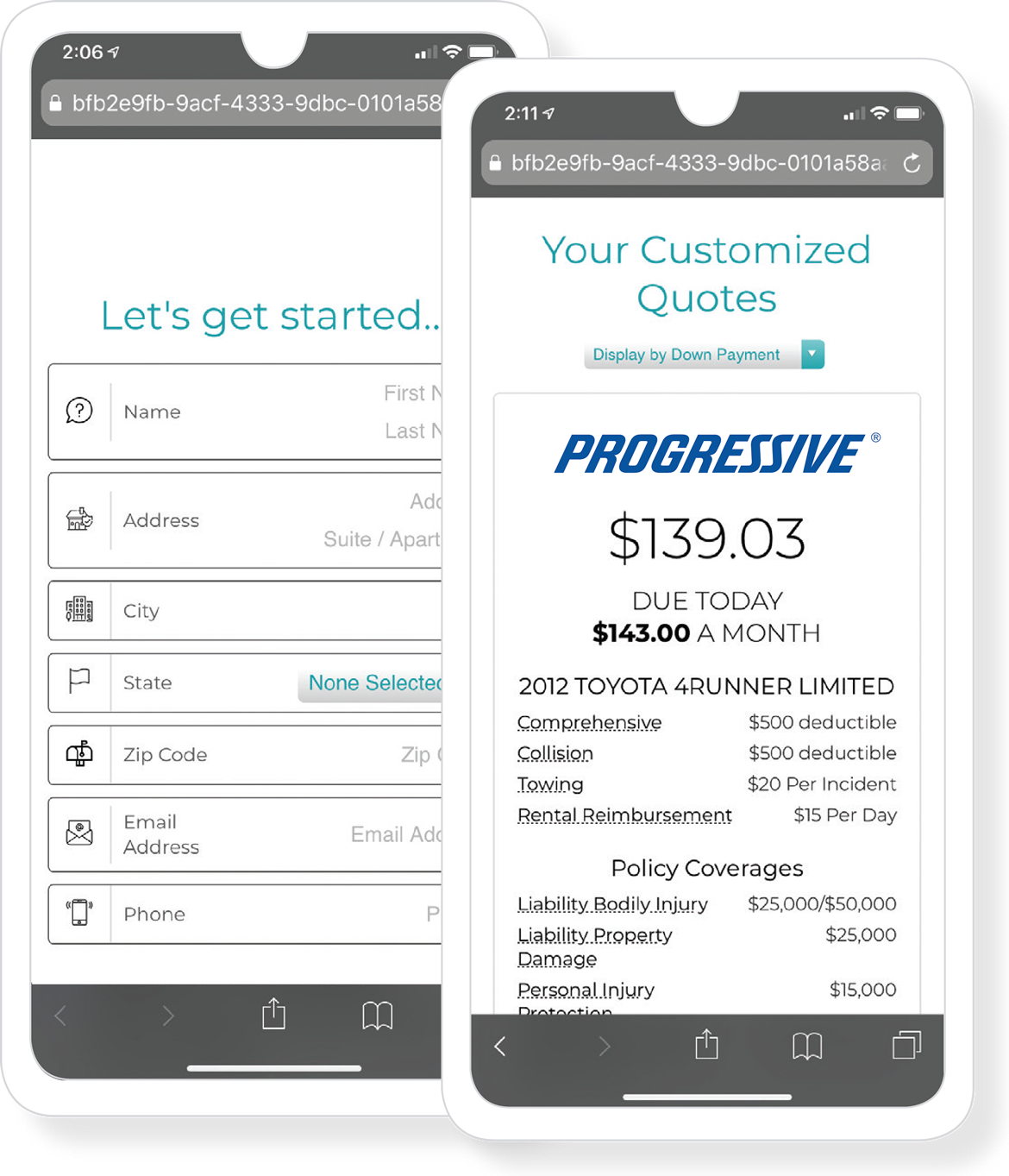

When Navigating Insurance Quotes, it's essential to know what factors to consider to ensure you're making an informed decision. First, always compare multiple quotes from different providers to identify the best rates and coverage options. Factors such as deductibles, coverage limits, and additional endorsements can significantly impact your premiums. Look for comprehensive policies that suit your specific needs, whether for health, auto, or home insurance. Make note of the financial stability and customer service reputation of the insurers you're considering, as this can affect your overall experience should you need to file a claim.

Conversely, there are several pitfalls to avoid when seeking insurance quotes. Beware of quotes that seem too good to be true, as they often come with hidden clauses or lack critical coverage. Always read the fine print to understand any exclusions that may affect your policy. Additionally, it's wise to steer clear of insurers with poor ratings or negative customer feedback, regardless of how enticing their quotes appear. Remember, a low premium may result in inadequate coverage, leaving you vulnerable during unexpected events. By being cautious and informed, you can successfully navigate the complex landscape of insurance quotes.