CG Insights

Explore the latest trends and insights in technology and culture.

Trade Bots in CS2: Your New Best Friends or Just Fancy Algorithms?

Uncover the truth about trade bots in CS2: Are they your ultimate allies or just clever algorithms? Explore the hype!

Understanding Trade Bots: How They Work in CS2

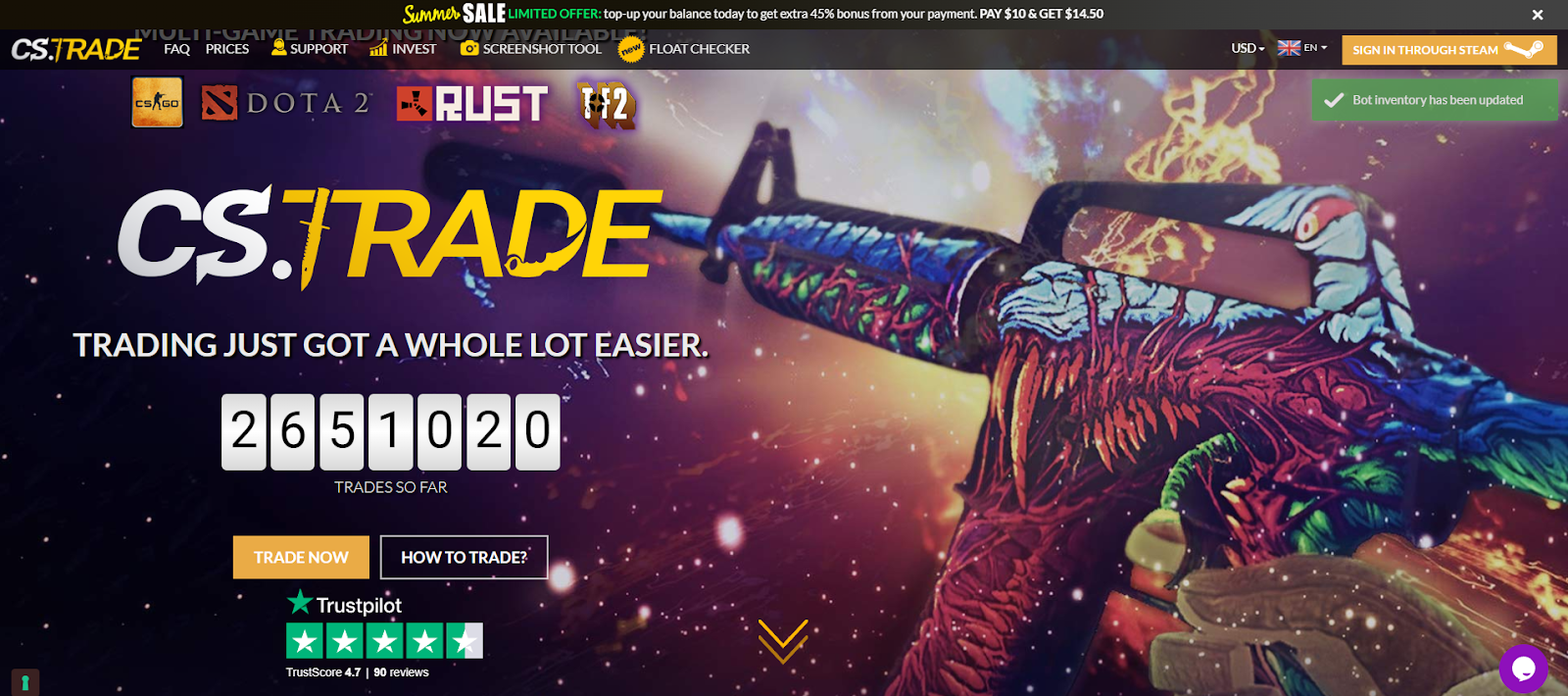

Understanding trade bots in CS2 can significantly enhance your gaming experience and streamline transactions. Trade bots are automated systems designed to facilitate the exchange of in-game items or currency between players with minimal manual intervention. Utilizing algorithms, these bots monitor market trends and player preferences, allowing them to execute trades based on predefined criteria. By understanding how trade bots operate, players can make informed decisions, ensuring they get the best value for their in-game assets.

Typically, trade bots operate by connecting to various CS2 platforms and leveraging APIs to gather real-time data. This data includes item prices, user demand, and trading history, which the bots analyze to identify ideal trading opportunities. Trade bots can be programmed with specific strategies, such as buying low and selling high or even engaging in arbitrage practices across different markets. This automation saves players time, increases trading efficiency, and can ultimately lead to greater returns on their investments.

Counter-Strike is a popular team-based first-person shooter game that has captivated players since its release. One of the exciting aspects of the game is the ability to customize weapons and characters using various skins, which can be obtained through dmarket cases. Players can compete in various game modes, testing their skills and strategies against opponents from around the world.

Are Trade Bots Changing the Game in CS2?: Pros and Cons

The rise of trade bots in CS2 is undeniably transforming the gaming landscape, offering players new avenues for item trading and acquisition. These automated systems can efficiently manage trades around the clock, eliminating the time-consuming manual processes traditionally involved. However, the integration of bots is not without controversy. While they streamline transactions and foster a more dynamic economy, they can also lead to issues such as market manipulation and unfair trading practices, raising concerns about player integrity and the overall balance of the game.

On the flip side, the advent of trade bots brings forth significant advantages for gamers seeking to optimize their inventory. For example, players can engage in rapid item exchanges without needing to scout potential trades manually. CS2 enthusiasts can also benefit from automated price tracking, ensuring they receive fair value for their virtual goods. Nonetheless, the downside remains, as the prevalence of bots might discourage genuine interactions between players and undermine the social aspects of trading. As the CS2 community navigates these changes, weighing the pros and cons of trade bots will be crucial for fostering a healthy and engaging gaming environment.

Top 5 Benefits of Using Trade Bots in CS2

In the competitive landscape of CS2, leveraging trade bots can significantly enhance your trading strategy. Firstly, these automated tools operate 24/7, allowing you to seize opportunities around the clock without the need for constant monitoring. This means you can capitalize on market fluctuations as they happen, ensuring that your trades are executed at optimal times. Additionally, trade bots remove the emotional element from trading, making decisions based purely on data and algorithms, which can lead to more consistent results.

Another key benefit of using trade bots in CS2 is the ability to backtest trading strategies effectively. This feature allows traders to analyze historical performance using simulated trading to understand how specific strategies would have fared in different market conditions. By identifying profitable patterns and avoiding losing strategies, you can refine your approach and boost your profitability. In summary, incorporating trade bots not only saves time but also enhances decision-making and strategy development, paving the way for more successful trading outcomes.